Accidents Involving Uninsured and Under-Insured Motorists

Being involved in a car accident with an uninsured or under-insured motorist can be incredibly stressful. However, most insurance companies offer additional coverage for these instances.

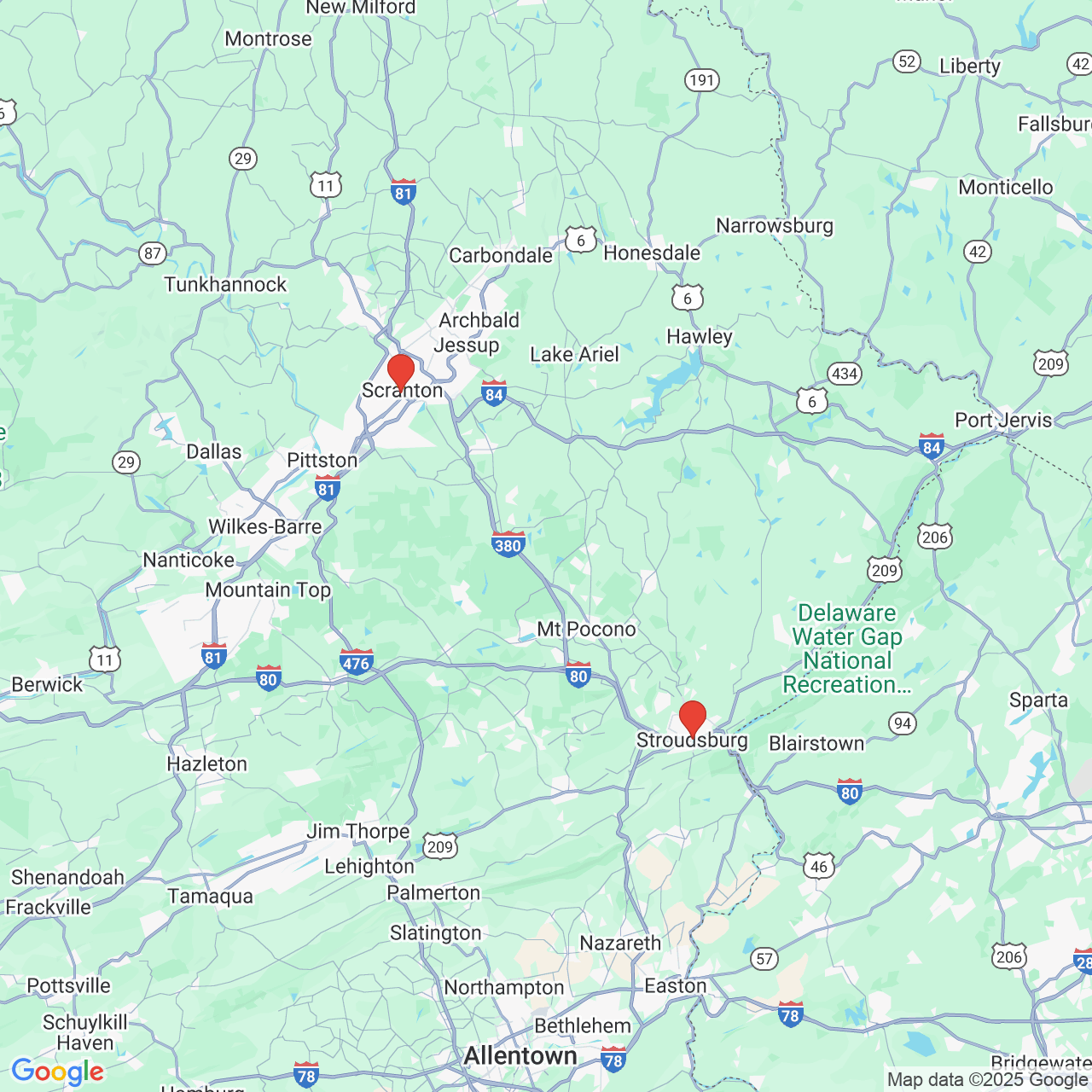

The team at our personal injury attorney offices in Scranton and Stroudsburg, PA, can help you with your car accident case by exploring options with your own insurance company and pursuing maximum compensation from the at-fault driver.

What should you do if you have been in an accident with an under-insured driver?

Immediately after a Car Accident, You Should:

- Stay on the Scene: If you have been in an accident, you should speak to the authorities before leaving the scene. In addition, you should move your vehicle out of traffic if you can do so safely.

- Get Help: Even for minor accidents, we recommend notifying the police as soon as possible. Contact emergency personnel as well if there are any injuries.

- Exchange Information: While on the scene, exchange information with the other drivers involved, including contact and insurance information. If they do not have insurance, gather all information necessary to identify and reach that person.

- Gather Evidence: We highly recommend taking pictures or videos of the scene of the accident, as well as the vehicles and any injuries. If possible, speak to witnesses and get their contact information.

- Avoid Admitting Fault: Do not apologize even if you believe you may be to blame. Doing so could ruin your case and keep you from collecting compensation.

- Contact an Attorney: You should contact our office as soon as you can do so safely.

Schedule Your Free Consultation

If you were in an accident with an uninsured or underinsured motorist, our team can help you collect the compensation you need to cover damages to your vehicle and any bodily injury.

To schedule your consultation, call us at:

(800) 523-6539

Schedule a Free Consultation Online

About One in Eight Drivers Are Uninsured

*According to the Insurance Information Institute

Uninsured vs. Under-Insured Motorists

Uninsured motorists are drivers who do not carry the required liability insurance. Under-insured motorists are typically drivers that do carry liability insurance, but their policy limits are too low to cover property damage or medical bills if they are involved in an accident. Almost all insurance companies offer additional uninsured and under-insured coverage. These policies help you cover the expenses associated with a car accident when an uninsured or under-insured driver is involved.

As of 2012, it was estimated by the Insurance Information Institute that more than 12% of all drivers are either uninsured or under-insured.

As of 2012, it was estimated by the Insurance Information Institute that more than 12% of all drivers are either uninsured or under-insured. Fortunately, Pennsylvania has one of the lowest rates of uninsured drivers in the country at just 6.5%. States with higher rates of uninsured drivers typically require that all drivers maintain uninsured and/or under-insured motorist coverage.

Determining Liability

In some cases, it is obvious that the other driver was at fault. It is especially helpful when eyewitnesses can verify that the other driver was speeding or otherwise driving recklessly. In other cases, determining liability is more difficult. It is important to contact an attorney as soon as possible after an accident.

Our expert attorneys can help you determine which party is at fault for the accident. When filing a claim with your insurance company for an accident involving an uninsured driver, you must prove that the uninsured driver was at fault. If you are a driver who is not at fault and you are also insured, the law is on your side. We will fight relentlessly to protect your rights and help you recover the damages you deserve.

Pursuing Damages

Pursuing damages when an uninsured or under-insured driver is at fault is different than when both drivers are insured. If the other driver had insurance, you would file your claims with their insurance company and their policy would cover your property damage and medical expenses. With an under-insured driver, their policy may only cover a small portion of the damages you have suffered, leaving you to cover the rest.

If the other driver had no insurance at all, the cost of your property damage and medical expenses falls on you. If you have uninsured/under-insured coverage, these policies will help cover your expenses. Your insurance company must handle your claim in good faith. If they fail to do so, or place unreasonable obstacles in your way, this is considered bad faith. In bad faith claims, not only must the insurance company pay damages for your property, medical expenses, lost wages, and more, but they must also pay punitive damages.

Contact Foley Law Firm

If you were involved in an accident caused by an uninsured or under-insured motorist, contact our law firm online right away or call us at (800) 523-6539 to discuss your case. The sooner you seek legal representation, the better chance you have of recovering full compensation.